Finance

Like We Said... Financial Services Reform is Next

Published March 25, 2010, 8:42 am, CST

Update: March 25, 2010, 2:18 pm, CST

by Diane W. Collins

dcollins@marketingweb.com

|

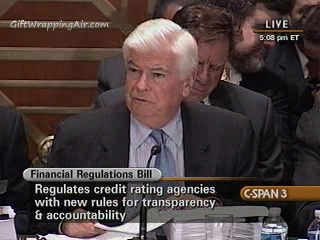

Restoring American Financial Stability Act of 2010 Sen. Chris Dodd (D-CT), Chairman Senate Banking, Housing & Urban Affairs |

Financial Reform is next and fast-tracking through Congress. Monday, March 22nd in Briefs we reported the Restoring American Financial Stability Act of 2010 was passed out of the Senate Banking, Housing & Urban Affairs Committee with a split directly down party line 13 to 10. The bill now goes to the Senate floor. You can expect to see action following the legislative Spring Break.

Sen. Chris Dodd, Chairman of the committee had been working in a somewhat successful bipartisan manner with Republicans Sen. Richard Shelby (R-AL), Ranking Member and Sen. Bob Corker (R-TN) among others. Dodd suddenly announced they would be moving the bill out of Committee shocking committee members. The bill was filed on March 15th. The announcement was accompanied by press briefings from both Sen. Dodd and Sen. Corker with Sen. Corker visibly limiting and restraining his response.

|

Sen. Richard Shelby (R-AL) Ranking Committee Member |

The pressure to move the bill seems to have come from the White House looking for new "talking-points" as the future of Health Care Reform was unsure at that time. As we said in a March 21st update to our article, Next? Financial Services Reform... Dodd's Bill

We believe this is worth watching. Even as the Democrats take over one-sixth of our economy with health care reform they are turning their attention to our Financial Services Industry. Like Health Care there are areas of reform that are desperately needed. Let's make sure that is what is addressed, unlike this Health Care debacle. And, with all due respect it is difficult not to mention the irony. Treasury Secretary, Tim Geithner did not pay his taxes. Sen. Dodd took a sweetheart deal from Countrywide... And the beat goes on.

This week we have been watching committee hearings on "all things financial." The testimony of Treasury Sec. Tim Geither, Federal Reserve Chairman Ben Bernanke, and panel experts on various aspects of financial institutions regulation and jurisdiction... the role of the Fed. In addition committees have met reviewing consumer finance, credit cards, and foreclosures.

To our minds, the most important issue is the shift of power. The intent appears to be a weakening of the Federal Reserve's ability to regulate all aspects of finance creating instead an "independent" regulatory board for consumer finance issues. How this will impact the Fed's ability to set effective monetary policy in light of more restricted access to the activities of smaller banks has been questioned. Further, to whom will the consumer regulatory board report? It has been proposed to be independent with its own budget yet housed in the Treasury Department building. It is said it will be similar to the FDIC, however, its mandate will be consumer finance.

Sen. Richard Shelby (R-AL) and other Republicans disagree on the need for additional regulatory entities suggesting the ones we currently have are capable of instituting any financial reform legislation the Congress passes. Both Fed Chairman Ben Bernanke and FDIC Chair, Shelia Bair began their positions as appointees of President George W. Bush. Mr. Bernanke has been appointed to an additional term by President Obama. Ms. Blair has announced her intention to retire at the end of her term. Both of them have had their "dust ups" with Treasury Secretary Tim Geithner.

Our focus? We want to determine if there is a push to extend the powers of the Executive branch through financial reform legislation. Will it put the "balance of powers" as established by our country's founders in danger. Will it make government even more intrusive or will it actually provide protection against financial predators. Will it interfere with the monetary policy road we're on that we must carefully monitor should inflation raise its ugly head? Complex... yes. More as the debate progresses.

Further reading: