Finance

Political Agendas: The Balancing Act

Published April 22, 2010, 9:38 am, CST

by Diane W. Collins

dcollins@marketingweb.com

As 2010 mid-term elections loom in the background, political agendas flex to meet polling expectations. Yes, unfortunate... but true. While conservatives fight to ensure proper regulation is instituted and the deficit is reduced through FY2011 constraints, the Obama administration has already moved on with plans for immigration reform and cap-and-trade. But, let's be wise and deal with our present hand while keeping an eye on the future.

As 2010 mid-term elections loom in the background, political agendas flex to meet polling expectations. Yes, unfortunate... but true. While conservatives fight to ensure proper regulation is instituted and the deficit is reduced through FY2011 constraints, the Obama administration has already moved on with plans for immigration reform and cap-and-trade. But, let's be wise and deal with our present hand while keeping an eye on the future.

Currently, Obama's administration continues their push for financial reform and the failed attempt to paint Republicans as Wall Street and Big Bank supporters. In reality, the campaign contributions of those entities and the fact that Goldman Sachs is known as "Government Sachs" paints both parties with the same brush... albeit unequally. Obama accepted approximately $1M in 2008 campaign contributions from Goldman Sachs... much more than Republicans.

The rush to financial reform legislation has not produced and mostly likely will not produce the political currency the administration intended. The Restoring American Financial Stability Act of 2010, Chris Dodd's bill is still being negotiated with Republicans obtaining concessions regarding the $50B bailout or "wind down" provision for large banks and President Obama's eventual call for its removal from the bill. And how incredible is the irony that Fannie and Freddie's lending criteria are not included in the legislation, something we reported yesterday. Dodd's ties to Fannie and Freddie and the responsibility these corporations bear for "liar loans" and the foreclosure debacle are well documented.

|

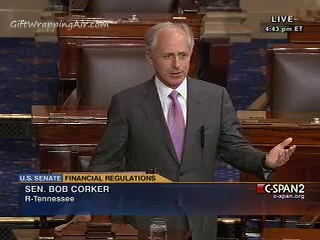

Sen. Bob Corker (R-TN) Financial Reform |

Attention has been given to the Democrat's intention to create a separate Consumer Protection Agency which on face value seems appropriate. However, like so much regarding this administration the "devil is in the details." Republicans must ensure Treasury powers are not unduly expanded by the creation of this entity at the expense of the Federal Reserve whose need for information regarding small community banks is necessary to the Fed's analysis of monetary factors and controlling potential future inflation.

In addition, the need for a separate agency is in doubt. Our existing regulatory authorities, the SEC and Federal Reserve have the ability to protect consumers. They simply need to do their jobs. This is especially evident for the Securities and Exchange Commission made apparent by the Lehman Brothers testimony before congress with regard to Repo 501 transactions. Allowing corporations to present a "snapshot in time" of their financial picture in order to imply a better capital reserves and liquidity position without question is in our opinion a dereliction of duty to the public. Perhaps stronger language regarding the execution of duties is needed. The creation of a "new agency" is a public relations stunt devised by Democrats to give the appearance of "working for the people" when in essence it has been an attempt to further concentrate power under the Treasury and extend Executive Branch authority.

The Wall Street Transparency and Accountability Act was passed out of the Senate Agriculture Committee yesterday and is to be attached to Dodd's bill in order to better regulate the derivatives market and to answer this problem to some degree. However, the rush to get this legislation out of committee and to the Senate floor by Chairman Blanche Lincoln (D-AR) who submitted a last minute mark-up for the bipartisan base bill constructed in committee over several months, raises eyebrows. Add to that the failure of the Republican supported Chambliss Amendment to the Act before leaving committee and the fact that many senators had not seen Chairman Lincoln's substitute mark-up prior to the vote... one begins to see the all too common pattern of the Obama Administration.

Today, President Obama will continue the balancing act with his address supporting Financial Reform legislation the delivery of which is staged on Wall Street. Predictably, he is expected to call for quick passage and the bill is anticipated to hit the Senate floor end of this week or early next week. But what's next? Important question. The Democrats need to replace votes. Votes they've lost both on the far Left and with Independents over broken promises. They will turn their attention to a new source of votes... immigrants. The spin will include a "responsible" plan toward reforming current immigration laws including new high tech social security cards; stricter enforcement of employment laws; a "fair" pathway to citizenship for illegals. But, they won't build the border fence and there's method in their madness. As they continue to break promises, disappoint and lose supporters, the Left will need a constant flow of new blood. They can't close the border. This is their Achilles heal, but I digress. First Obama will secure new votes. Then, Cap-and-Trade will come to the Senate floor. More on this tomorrow.

COMMENTS:

Further reading: